- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

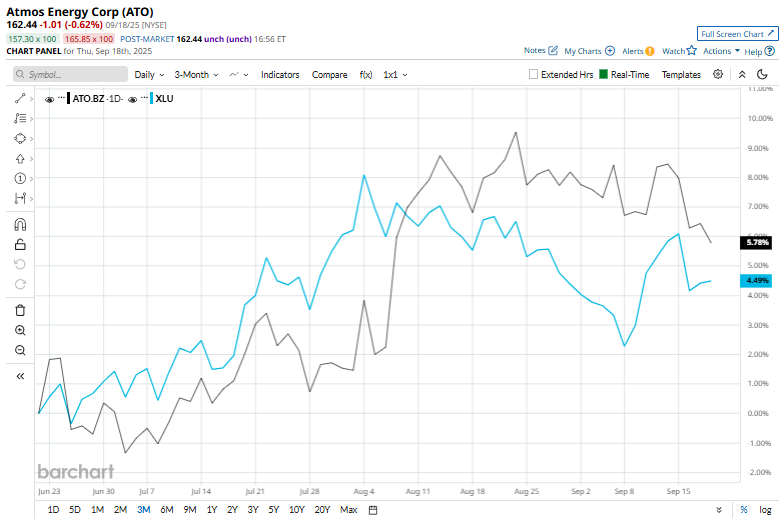

Atmos Energy Stock: Is ATO Outperforming the Utilities Sector?

With a market cap of $26.2 billion, Atmos Energy Corporation (ATO) is one of the largest fully regulated natural gas-only distributors in the United States. Headquartered in Dallas, Texas, the company serves over 3.3 million distribution customers across more than 1,400 communities in states such as Texas, Louisiana, Mississippi, Tennessee, and Virginia.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and ATO perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the regulated gas utilities industry. Atmos Energy is known for its stable, regulated earnings model, which provides predictable cash flows. A significant portion of its strategy focuses on system modernization and safety investments, including pipeline upgrades and reliability enhancements.

ATO shares have retreated 3.8% from their 52-week high of $168.86, achieved on Aug. 22. Over the past three months, ATO stock has gained 6.6%, trailing the Utilities Select Sector SPDR Fund's (XLU) 4.8% return over the same time frame.

In the longer term, shares of ATO rose 16.6% on a YTD basis and climbed 19% over the past 52 weeks, outperforming XLU’s YTD climb of 11.5% and 7.6% returns over the last year.

To confirm the bullish trend, ATO has been trading above its 200-day moving average over the past year. However, the stock has been trading over its 50-day moving average since the end of July.

Atmos Energy shares jumped 3.6% on Aug. 7 after the company reported solid Q3 results. Revenue rose 19.6% year-over-year to $838.8 million, slightly ahead of estimates, while EPS of $1.16 matched forecasts. Net income increased 12.6% to $186.4 million, driven by customer growth and $2.6 billion in infrastructure investments, 86% of which were targeted at safety and reliability. The company also raised its full-year EPS outlook to $7.35–$7.45, declared a $0.87 dividend, and highlighted $5.5 billion in liquidity, reinforcing confidence in its steady growth trajectory.

ATO’s rival, Southwest Gas Holdings, Inc. (SWX) shares lagged behind ATO, with an 11.7% uptick on a YTD basis and a 7.6% rise over the past 52 weeks.

Wall Street analysts are moderately bullish on ATO’s prospects. The stock has a consensus “Moderate Buy” rating from the 14 analysts covering it, and the mean price target of $165.50 suggests a potential upside of 1.9% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.