- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

How Is Avery Dennison's Stock Performance Compared to Other Discretionary Stocks?

/Avery%20Dennison%20Corp_%20logo%20on%20builsing%20by-%20Mark%20Roget%20Bailey%20via%20Shutterstock.jpg)

Mentor, Ohio-based Avery Dennison Corporation (AVY) operates as a packaging company, providing pressure-sensitive materials and a variety of tickets, tags, labels, and other converted products. With a market cap of $12.9 billion, its operations span the Americas, the EMEA, and the Indo-Pacific.

Companies worth $10 billion or more are generally referred to as “large-cap stocks.” Avery Dennison fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the packaging & containers industry.

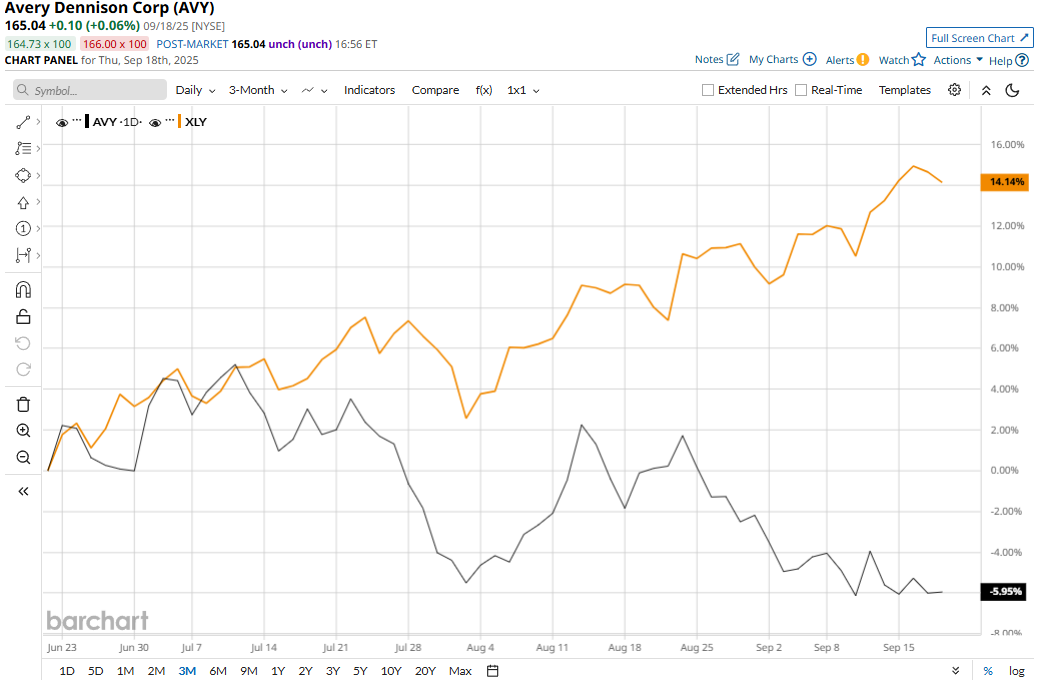

Despite its notable strengths, the stock has tanked 26.4% from its 52-week high of $224.38 touched on Sept. 27, 2024. Meanwhile, the stock has declined 5.1% over the past three months, notably underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 14.3% surge during the same time frame.

The stock’s performance has remained grim over the longer term as well. AVY stock has declined 11.8% on a YTD basis and 21.2% over the past 52 weeks, underperforming XLY’s 7.2% uptick in 2025 and 24.8% surge over the past year.

Further, AVY stock has remained mostly below its 50-day and 200-day moving averages over the past year, highlighting its bearish trend.

Avery Dennison’s stock prices gained 1.5% in the trading session following the release of its mixed Q2 results on Jul. 22. Due to the current administration’s tariff policies, demand from apparel and general retail categories remained under pressure, which was mostly offset by growth in the company’s high-value categories. Overall, its net sales came in at $2.2 billion, down 66 bps year-over-year, missing the Street’s expectations.

Meanwhile, its adjusted EPS remained flat at $2.42 and surpassed the consensus estimates by 1.7%. Following the initial uptick, AVY stock prices maintained a downward trajectory for eight subsequent trading sessions.

When compared to its peer, AVY has slightly underperformed Ball Corporation’s (BALL) 10.8% decline in 2025, but slightly outperformed BALL’s 26% plunge over the past 52 weeks.

Among the 13 analysts covering the AVY stock, the consensus rating is a “Moderate Buy.” Its mean price target of $199.50 suggests a 20.9% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.