- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

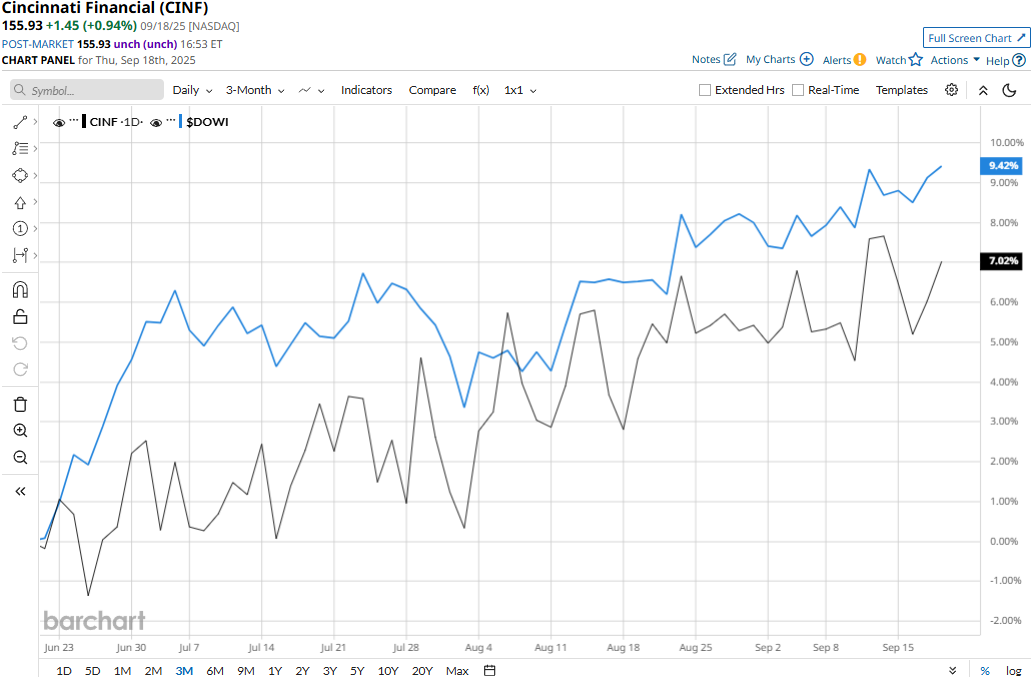

Is Cincinnati Financial Stock Outperforming the Dow?

/Cincinnati%20Financial%20Corp_%20phone%20screen-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Ohio-based Cincinnati Financial Corporation (CINF) provides property and casualty insurance, along with other investment services. With a market cap of $24.2 billion, the company operates through Commercial Lines Insurance, Personal Lines Insurance, Excess and Surplus Lines Insurance, Life Insurance, and Investments segments.

Companies worth $10 billion or more are generally referred to as “large-cap stocks.” CINF fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the property & casualty insurance industry.

CINF stock touched its all-time high of $161.74 on Nov. 27, 2024, and is currently trading 3.6% below that peak. Meanwhile, the stock has gained 7% over the past three months, slightly underperforming the Dow Jones Industrial Average’s ($DOWI) 9.4% uptick during the same time frame.

Over the longer term, CINF has outperformed the Dow. The stock has gained 8.5% on a YTD basis and 14.4% over the past 52 weeks, compared to Dow’s 8.5% uptick in 2025 and 11.2% returns over the past year.

Further, CINF has traded mostly above its 200-day moving average over the past year and above its 50-day moving average since early May, underscoring its uptrend.

Cincinnati Financial’s stock prices gained 3.6% in the trading session following the release of its impressive Q2 results on Jul. 28. The company observed a notable 15% growth in premiums earned, along with a solid increase in investment gains and other revenues. Its overall topline came in at $3.2 billion, up a massive 27.7% year-over-year. Moreover, the company observed notable margin improvements during the quarter, resulting in a staggering 52.7% year-over-year surge in non-GAAP operating income per share to $1.97, beating the consensus estimates by 41.7%.

When compared to its peer, CINF stock has also outperformed Allstate Corporation’s (ALL) 6.7% uptick in 2025 and 7.7% gains over the past 52 weeks.

Among the 10 analysts covering the CINF stock, the consensus rating is a “Moderate Buy.” Its mean price target of $163.33 suggests a modest 4.7% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.